Explaining pLQ by Growth Distributions

Understanding the Probability of Surpassing the Threshold

To translate the characterization of jumps in , , and thus into the probability of surpassing the threshold (denoted as pLQ), we need to focus on explaining pLQ through growth distributions. Our task is to count all cases where jumps result in .

Integrating Growth Distributions

This involves integrating the growth distributions that describe the volatility of and . For any initial point , , consider combinations of jumps in both and that might result in exceeding the threshold in the next timestep. If an observation is below the threshold, it can surpass it by either shrinking enough or growing sufficiently. These represent the pure , directions of the oblique axes in the plot (see Figure: Coordinates). Intermediate combinations of changes in and , if intense enough, may also achieve this. The general accounting for these situations is done via integration in the equation for pLQ.

Assuming the growth rate distribution is separable, it can be expressed as a product of two one-dimensional marginal growth distributions: . This is integrated numerically in the region.

Numerical Integration Procedure

For the numerical integration of these 2D growth rate probabilities, the following procedure is applied:

- Binning Observations: Observations are binned into intervals with centers . By comparing observations at consecutive time periods, histograms of are observed for each bin. These histograms, normalized by bin population, estimate the assumed .

- Creating Interpolators: A 2D continuous interpolator is created to estimate the chances of becoming after one time period. The same procedure is applied to the variable.

- Estimating : is estimated as for the chances of jumping in the 2D LQ plane.

The numerical integration is performed by evaluating growth rate interpolators on a fine grid covering a large rectangle about point and storing it in a 2D numpy array G. The condition is stored in another array C of the same shape. The integration is computed as (G * C).sum() / G.sum().

Implications of Volatility Decay

The decay of volatility with size (see Figure: Volatility Decay) implies that larger observations and those from larger countries and products are less volatile. This feature results in a lower likelihood for a large observation to surpass , compared to a smaller observation , given they start at the same level.

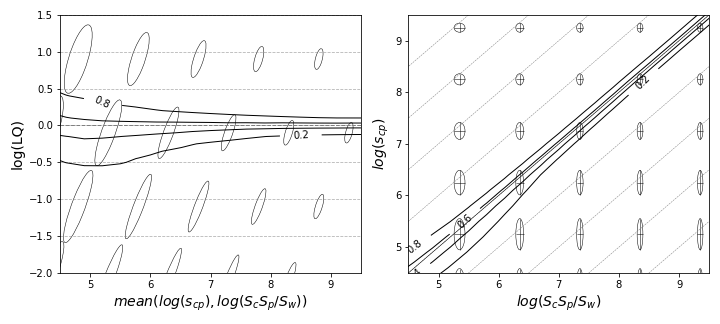

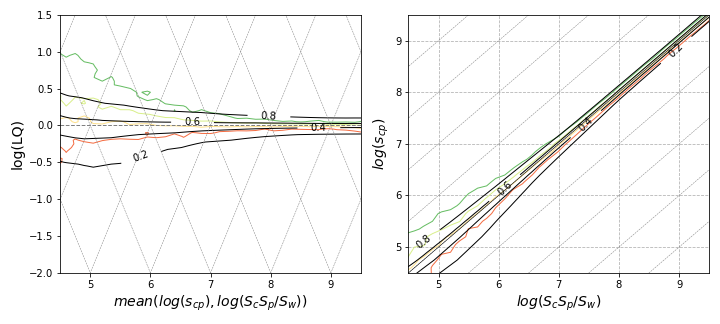

Figure: Growth Rate Model illustrates the model of uncorrelated growth rates in the variables and . The ellipses depict the standard deviation of these variables. Changes in the transition width of pLQ can be qualitatively explained by the dependence of the moments and on , .

Validating the Model

To validate this model for reconstructing pLQ, a comparison is made with level curves of pLQ from the knn estimator. A qualitative match is observed in the patterns of widening of the effective LQ metric with decreasing values. The transition and size effects relevant to the level can be evaluated by measuring and along this line.

Generalizing the paths suggested here may allow further exercises where the volatility in is explained by volatilities in all four sizes , , , and separately. The formal tools can be extended to cover such settings, although the schemes may need to be adapted for four variables instead of two.