pLQ as Predictor for Diversification

pLQ as a Predictor for Diversification

In this section, we explore how the pLQ (probability of Location Quotient) integrates into a framework for predicting diversification. We compare a fixed effects regression, inspired by Hausmann's approach, using both the binary and pLQ. The second independent variable is proximity .

Proximities are computed using the same operations but start from and pLQ matrices respectively. These variables coincide for most practical purposes.

The regression equation includes dummies for each country-product and time period fixed effects:

- : Represents a country-product.

- : Dependent variable indicating if for country-product at time .

- : Intercept term.

- : Refers to either pLQ or binary for country-product at time .

- : Dummies for country-product and time step.

- : Corresponding coefficients.

- : Error term.

To manage the numerous dummies, we apply the within transformation:

This transformation 'sweeps' the and effects, allowing us to fit the within estimators using OLS:

The results are summarized below:

| Fitted Coefficients (1) | Fitted Coefficients (2) | |

|---|---|---|

| Binary LQ () | 0.756 | |

| (0.001) | ||

| pLQ () | 0.986 | |

| (0.001) | ||

| Density () | 0.065 | 0.021 |

| (0.001) | (0.001) | |

| Adj. R-squared | 0.682 | 0.623 |

| No. of Observations | 1,404,542 | 1,404,556 |

Note: Statistically significant at the 0.01% level.

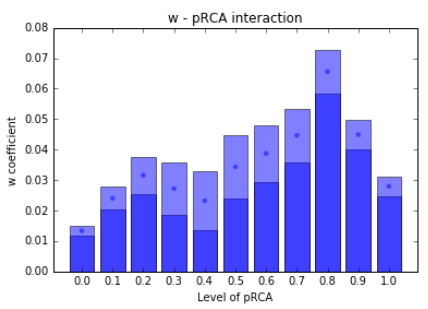

We also examine if the role of density varies for different levels of pLQ. By applying a simple interaction with a dummy indicating the level of pLQ, the fitting equation becomes:

The mean value and 2.5% - 97.5% confidence interval for all density coefficients are plotted in the figure below. This suggests that density plays a more significant role for products slightly above the threshold.

A possible integration of this framework into similar regressions could involve assigning a value of 0.5 to indicate if a country exports a product with an intermediate level of LQ.