Micro to Macro Fluctuations

Understanding the Transition from Micro to Macro Fluctuations

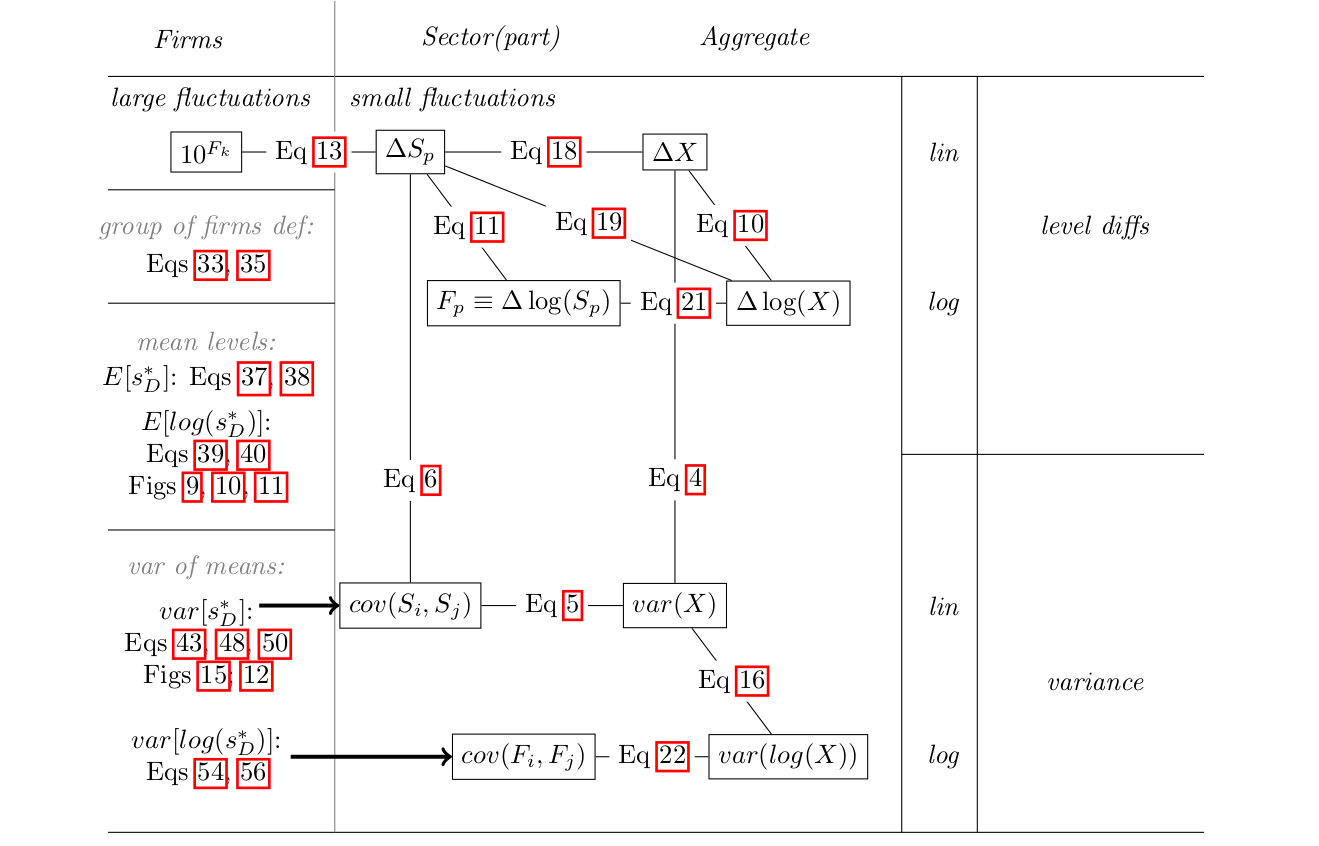

This section provides an overview of how micro-level fluctuations aggregate into macro-level fluctuations, both in linear and log terms. The scheme in Figure 1 illustrates the relationships and equations discussed below.

Key Components

-

Firms:

- Large fluctuations are represented by .

- Group of firms defined by specific equations:

- Quantile Sum: Refer to Eq quantile_sum.

- Power Sum: Refer to Eq power_sum__narrow_bin.

- Mean levels:

- : See Eqs E_N, E_L.

- : See Eqs Elog_N, Elog_L and Figures Elog_mu0_fnq_0, Elog_sigma0_fmu_0, Elog_mu0_fsigma_0.

- Variance of means:

- : See Eqs alpha_1, var_N, var_L and Figures var_mu0_fsigma_0, fig:var_mu0_fnq_0.

- : See Eqs var_log_N, var_log_L.

-

Sector and Aggregate:

- Level differences:

- and .

- Equations: to (Eq eqa), to (Eq Ft_def).

- Variance:

- and .

- Equations: to (Eq var_cov_sum_def), to (Eq var_log_shocks).

- Level differences:

Equations and Relationships

- Growth Rate Equation:

- to (Eq growth_rates).

- Variance in Terms of Deltas:

- to (Eq var_delta).

- Logarithmic Relationships:

- to (Eq parts_linear_approx).

- to (Eq var_log).

This structured approach helps in understanding how individual firm-level fluctuations can aggregate into sectoral or macroeconomic fluctuations, emphasizing the importance of both linear and logarithmic transformations.